boulder co sales tax vehicle

The December 2020 total local sales tax rate was 8845. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state.

Rates Lafayette Co Official Website

The Colorado sales tax rate is currently.

. Real property tax on median home. For information related to specific tax issues for state county or RTD please contact the State Department of Revenue at 303-238-7378. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

The December 2020 total local sales tax rate was also 4985. Motor Vehicles 1 Revised November 2021 Motor vehicles are tangible personal property and are therefore subject to Colorado sales and use taxes. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods.

Boulder County CO Sales Tax Rate. City of Longmont 353 State of Colorado 290 RTD 100 Cultural District 010 Boulder County 0985 TOTAL Combined Sales Tax Rate in. You will have to pay sales tax on any private car sales in Colorado.

The rate is 29. The current total local sales tax rate in Boulder CO is 4985. Office of Financial Management PO.

The minimum combined 2022 sales tax rate for Boulder Colorado is. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition. City of Longmont Sales Tax Rates.

13 rows Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of. Sale Use Tax Topics. The value of the tax credit is 35 of the vehicle purchase price or 50 of the vehicle conversion cost up to 7500 for vehicles with a gross vehicle weight rating GVWR up to 26000 pounds.

This is the total of state county and city sales tax rates. Sales Tax State Local Sales Tax on Food. Because the City of Boulder is home ruled and self.

The current total local sales tax rate in Boulder County CO is 4985. For instance if you purchase a vehicle from a private party for 20000 then you will. This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax.

BOULDER COUNTY USE TAX. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys.

The Bolt Euv Conquers The High Desert Chevy New Roads

New Honda For Sale In Boulder Co Fisher Honda

Ncar Fire Boulder County Lifts Large Number Of Evacuations As Crews Attack Fire Overnight

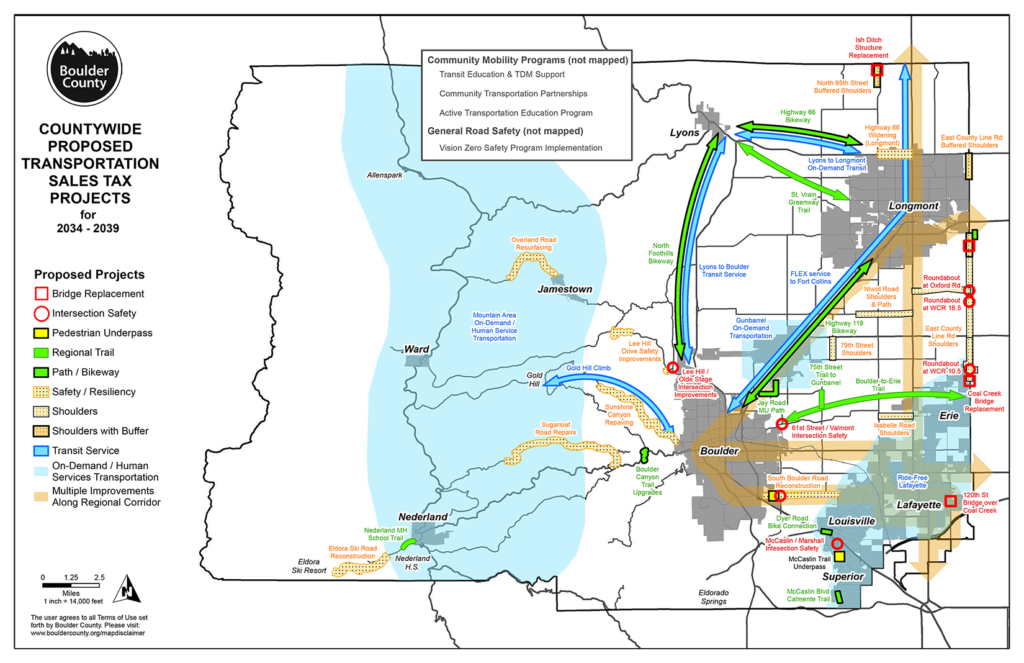

Proposed Extension Of Countywide Transportation Sales Tax Boulder County

2005 Bmw 3 Series 330i Boulder Cars

New Volkswagen For Sale Or Lease At Emich Vw Of Boulder In Colorado

Fowler Jeep Of Boulder In Boulder Co Cars Available Autotrader

Superiorstreets Town Of Superior Colorado

Find Your Used Cars Trucks Suvs In Boulder Co Flatirons Subaru

New Jeep And Used Car Dealer Fowler Jeep Of Boulder

New Toyota Models For Sale Lease Boulder Toyota Sale Corwin Toyota Boulder

890 Orman Dr Boulder Co 80303 Redfin

Bikeway Improvements Connectivity Top Boulder Priorities For County Transportation Tax

Colorado S Love Affair With Open Space Started With A Boulder Tax Experiment Colorado Public Radio

Boulder Toyota 4runner Toyota Colorado Springs Trd Pro Packages Corwin Toyota Boulder

New Jeep And Used Car Dealer Fowler Jeep Of Boulder

Proposed Extension Of Countywide Transportation Sales Tax Boulder County